10 May Q2 2022 Commentary

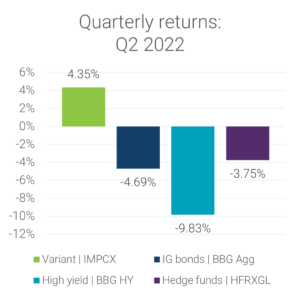

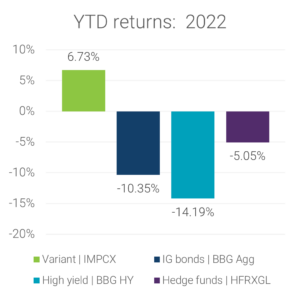

The Variant Impact Fund (the “Fund”) returned +4.35% in the second quarter of 2022, during a period of sharp market volatility across asset classes. Over the quarter, the Fund outperformed investment grade bonds, high yield corporate debt and hedge fund indices by substantial margins, demonstrating strong relative outperformance. For the YTD returns, IMPCX continued to outpace investment grade bonds, high yield corporate debt and hedge fund indices by meaningful differences.

Source: Bloomberg

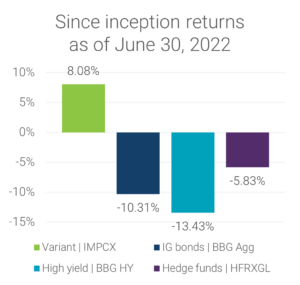

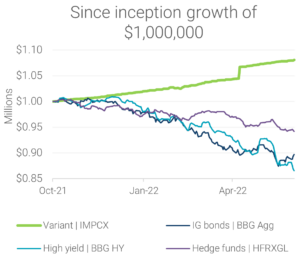

At the end of June, the Fund delivered cumulative since inception net returns of 8.08%, with relatively limited volatility or correlation to public market indices.

Source: Bloomberg

In terms of performance attribution, the majority of positions held in the portfolio during the quarter continued to deliver positive results and either met or exceeded expectations. The fund benefited from less correlated exposures across IRIS+ Impact Themes, with affordable quality housing, financial inclusion and energy efficiency providing the largest impact to returns over the quarter. Climate change mitigation was the sole negative contributor over the quarter.

As for portfolio positioning, Variant continued to deploy capital into current and new positions during the quarter. The Fund invested additional dollars with managers across spaces including small business lending to underrepresented founders, residential lease to own financing and emerging market microfinance. Regarding new investments, the Fund made a handful of initial investments across access to quality education, energy efficiency and clean energy. Within access to quality education, the Fund made a direct investment backed by income share agreements. As for energy efficiency, the Fund made a direct investment in the energy rebate factoring space. Lastly, an investment within clean energy was deployed in a secondary fund targeting four sectors: cleantech/climatech, sustainable food/agriculture, waste/water, and healthcare.

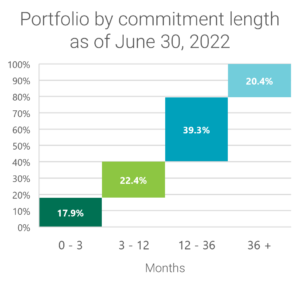

Assets under management grew over the quarter by $3.5 million and ended the quarter at $8.5 million. Liquidity management remains a key focus given the underlying private exposures and the current market environment. As of June 30th, the Fund could access an estimated 40% of its investments over a 12-month period.

The Fund paid out its dividend and executed a redemption offering during the quarter.

For current performance and holdings, please click here.

Past performance is not a guarantee of future results.

Inception date is November 1, 2021. Returns are net total returns. The track record uses geometric returns and reflects the reinvestment of earnings. Results are unaudited.

“IG bonds” & “BBG Agg ” refer to the Bloomberg U.S. Aggregate Index, which is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. “High yield” & “BBG HY” refer to the Bloomberg U.S. High Yield Index, which measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. “Hedge funds” & “HFRXGL” refer to the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe. “Equity” & “S&P 500” refer to the S&P 500® Index, which is a market-value weighted index of equity securities. Please note: The referenced indices are shown for general market comparisons. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or transaction costs. Reference indices are provided for illustrative purposes only. There are no known published benchmarks or indices comparable to the investment strategies of the Fund.

IRIS+ is the generally accepted system for measuring, managing, and optimizing impact. IRIS+ is a component of Global Impact Investing Network (“GIIN”).

The Variant Impact Fund (the “Fund”) is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. The investment objective of the Fund is to seek to provide a high level of current income. Capital appreciation is considered a secondary objective. The Fund will also seek to generate positive social and environmental impact by targeting investment opportunities that are both aligned with the United Nations Sustainable Development Goals (“UN SDGs”) and consistent with the Fund’s impact investing framework. There is no guarantee the Fund will achieve its objective. An investment in the Fund should only be made by investors who understand the risks involved, who are able to withstand the loss of the entire amount invested and who can bear the risks associated with the limited liquidity of Shares. A prospective investor must meet the definition of “accredited investor” under Regulation D under the Securities Act of 1933. Important Risks: In implementing the Fund’s impact investment strategy, the Investment Manager may select or exclude certain investments for reasons other than investment performance. For this reason, the Fund’s impact strategy could cause it to perform differently compared to funds that do not have such strategy. There is no guarantee that the Investment Manager’s definition of impact investing, security selection criteria or investment judgment will reflect the beliefs or values of any particular investor.

Currently, there is a lack of common industry standards relating to the development and application of environmental, social and governance (ESG) criteria, which may make it difficult to compare the Funds’ principal investment strategies with the investment strategies of other funds that integrate certain “impact” criteria. The substantial investment by the Fund in private securities, there is no reliable liquid market available for the purposes of valuing the majority of the Fund’s investments. There can be no guarantee that the basis of calculation of the value of the Fund’s investments used in the valuation process will reflect the actual value on realization of those investments. Shares are an illiquid investment. You should generally not expect to be able to sell your Shares (other than through the repurchase process), regardless of how the Fund performs. Although the Fund is required to implement a Share repurchase program only a limited number of Shares will be eligible for repurchase by the Fund. The investment in the Fund is speculative, involves substantial risks, including the risk that the entire amount invested may be lost, and should not constitute a complete investment program.

The Fund may leverage its investments by borrowing, use of swap agreements, options or other derivative instruments. The Fund is a non-diversified management investment company, meaning it may be more susceptible to any single economic or regulatory occurrence than a diversified investment company. In addition, the fund is subject to investment related risks of the underlying funds, general economic and market condition risk. Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities, futures, commodities and derivatives, using leverage and engaging in short sales. The Fund’s investment performance depends, at least in part, on how its assets are allocated and reallocated among asset classes and strategies. Such allocation could result in the Fund holding asset classes or investments that perform poorly or underperform. Investments and investment transactions are subject to various counterparty risks. The counterparties to transactions in over the-counter or “inter-dealer” markets are typically subject to lesser credit evaluation and regulatory oversight compared to members of “exchange-based” markets. This may increase the risk that a counterparty will not settle a transaction because of a credit or liquidity problem, thus causing the Fund to suffer losses. The Fund and its service providers may be prone to operational and information security risks resulting from breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption, or lose operational capacity.

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED FROM (877) 770-7717 OR WWW.VARIANTINVESTMENTS.COM. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST. tnairavediserof

Foreside Fund Services, LLC, distributor.