05 Apr Q1 2019 Commentary

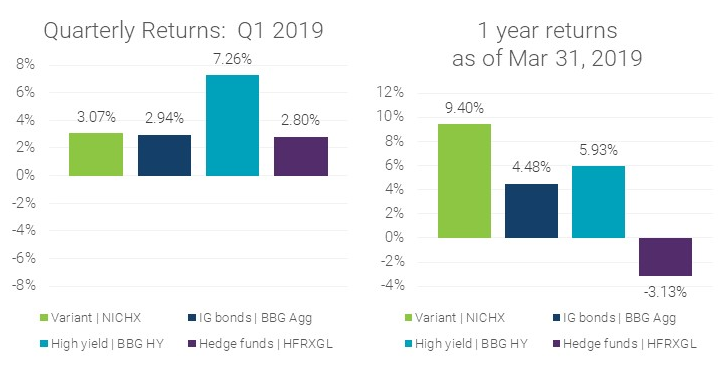

The Fund (NICHX) returned +3.07% in the first quarter of 2019, outperforming investment grade bond and hedge fund indices, but underperforming high yield corporate debt. Over the trailing year, the Fund was up +9.40%, outperforming these same indices over that period.

The Fund’s positive performance in Q1 was largely unrelated to the movements in interest rates, credit markets and other risk assets, but rather driven by events in individual portfolio exposures. Over the quarter and since inception, the Fund has displayed limited correlation or beta to public market indices in fixed income and equity markets.

In terms of performance attribution, most positions performed at or near expectations. The largest positive drivers of performance resulted from participation in the final close of an aircraft leasing strategy and origination points received on a direct deal in portfolio finance. In addition, exposure to specialized care in the UK, transportation finance and the closing of two new secondary market acquisitions of LP interests supported performance. The primary detractors from performance relative to expectations were exposures in litigation finance and self-storage. In addition, two existing positions in LP secondaries slightly underperformed.

Over the quarter, the Fund executed several new investments. In addition to the aircraft leasing strategy, portfolio finance and secondary LP trades mentioned above, new capital was deployed into a diversified specialty finance strategy, a credit facility to a provider of merchant cash advances to ecommerce businesses, a factoring strategy on FEMA receivables and a fund that repairs non-performing residential mortgage loans. The addition of the new investments served to further diversify the portfolio, which now holds 44 different positions across ten asset classes.

For current performance and holdings, please click here.

Inception date is October 2, 2017. Returns are net total returns. Between October 2017 and September 2018, performance is quoted for the Variant Alternative Income Fund LP, the predecessor private fund that converted into the interval fund. The predecessor fund was, in all material respects, equivalent to the interval fund. The private fund track record was adjusted to reflect the interval fund’s estimated expenses and expense limitations. Specifically, it reflects a management fee of 0.95% and fund expenses capped at 0.50%. The track record uses geometric returns and reflects the reinvestment of earnings. Results are unaudited.

Correlation is the performance relationship between the Fund and the reference indices on a monthly basis over the period. Beta measures the volatility of the Fund relative to the reference indices over the period.

“IG bonds” & “BBG Agg “ refer to the Bloomberg Barclays U.S. Aggregate Index, which is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. “High yield” & “BBG HY” refer to the Bloomberg Barclays U.S. High Yield Index, which measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. “Hedge funds” & “HFRXGL” refer to the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe. Please note: The referenced indices are shown for general market comparisons. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or transaction costs. Reference indices are provided for illustrative purposes only. There are no known published benchmarks or indices comparable to the investment strategies of the Fund.

The Variant Alternative Income Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. There is no guarantee the Fund will achieve its objective. An investment in the Fund should only be made by investors who understand the risks involved, who are able to withstand the loss of the entire amount invested and who can bear the risks associated with the limited liquidity of Shares. A prospective investor must meet the definition of “accredited investor” under Regulation D under the Securities Act of 1933.

Important Risks: Shares are an illiquid investment. You should generally not expect to be able to sell your Shares (other than through the repurchase process), regardless of how the Fund performs. Although the Fund is required to implement a Share repurchase program, only a limited number of Shares will be eligible for repurchase by the Fund. An investment in the Fund involves substantial risks, including the risk that the entire amount invested may be lost. The Fund may leverage its investments by borrowing, use of swap agreements, options or other derivative instruments. The Fund is a newly- organized closed-end management investment company that has limited operating history and no public trading of its shares. In addition, the fund is subject to investment related risks to include alternative investment risk, asset allocation risk, counter party credit risk, cybersecurity risk and general economic and market condition risk, please read the prospectus carefully for additional information of the Fund risk prior to investing.

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED FROM (877) 770-7717. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST.

Foreside Fund Services, LLC, distributor.