21 Jul Q2 2023 Commentary

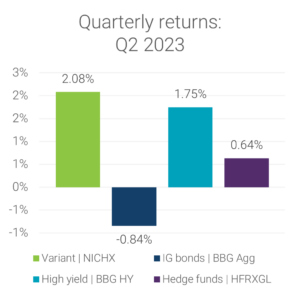

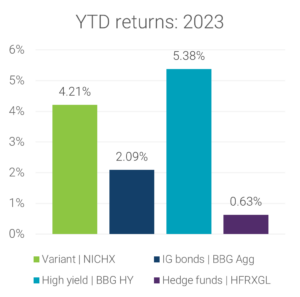

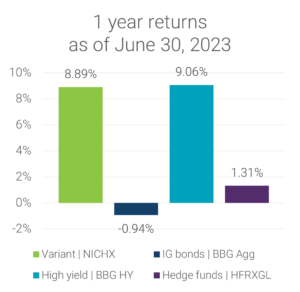

The Variant Alternative Income Fund (the “Fund” or NICHX) returned 2.08% in the second quarter of 2023 in a period of mixed performance across traditional markets. Over the quarter, the Fund outperformed investment grade bonds, high yield corporate debt, and hedge fund indices. For the YTD and 1-year returns, NICHX continued to outperform investment grade bonds and hedge fund indices, while slightly trailing high yield corporate debt.

Source: Bloomberg

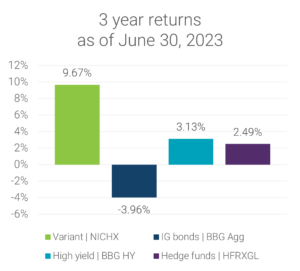

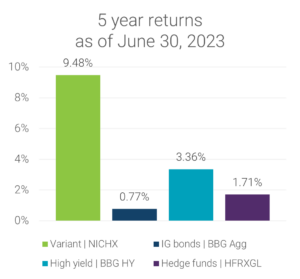

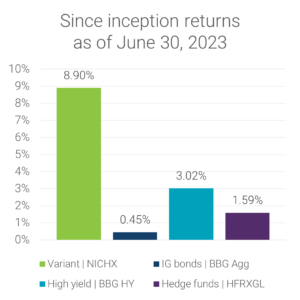

As for the longer-term annualized performance figures, the Fund has exhibited strong consistent performance across the three-year and five-year periods with net returns of 9.67% and 9.48%, respectively. At the end of June, the Fund delivered annualized since inception net returns of 8.90% with meaningful outperformance against the reported benchmarks.

Source: Bloomberg

In terms of performance attribution, the Fund continued to experience broad positive contributions across the majority of positions in the portfolio. The Fund benefited from core niche exposures, with specialty finance, litigation finance and transportation finance providing the largest positive impact to returns over the quarter. No asset class provided a negative contribution to performance in the 2nd quarter.

As for changes in portfolio positioning, Variant continued to invest capital into current and new positions. The Fund made follow-on investments with partners across areas of the market including real estate debt, film finance, debt settlements and emerging markets specialty finance. Regarding new investments, the Fund made initial investments across litigation finance and specialty finance. In the litigation finance bucket, the Fund structured a credit facility backed by medical receivables from a healthcare system. On the specialty finance side, the Fund deployed direct capital across investment themes including loans to charged-off debt buyers, insurance commission advances and emerging market specialty finance.

Assets under management grew over the quarter by $235 million and ended the quarter at $2,713 million. For the year, assets under management have increased by $778 million. Liquidity management remains a key focus given the underlying private exposures and the current market environment. As of June 30th, the Fund could access an estimated 36.2% of its investments over a 12-month period.

The Fund paid out its dividend and executed another redemption offering. This redemption offer fulfilled 100% of client requests without proration, as has been the case throughout the Fund’s history.

For current performance and holdings, please click here.

Past performance is not a guarantee of future results.

Inception date is October 2, 2017. Returns are net total returns. Between October 2017 and September 2018, performance is quoted for the Variant Alternative Income Fund LP, the predecessor private fund that converted into the interval fund. The predecessor fund was, in all material respects, equivalent to the interval fund. The private fund track record was adjusted to reflect the interval fund’s estimated expenses and expense limitations. Specifically, it reflects a management fee of 0.95% and fund expenses capped at 0.50%. The track record uses geometric returns and reflects the reinvestment of earnings. Results are unaudited.

“IG bonds” & “BBG Agg ” refer to the Bloomberg U.S. Aggregate Index, which is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. “High yield” & “BBG HY” refer to the Bloomberg U.S. High Yield Index, which measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. “Hedge funds” & “HFRXGL” refer to the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe. “Equity” & “S&P 500” refer to the S&P 500® Index, which is a market-value weighted index of equity securities. Please note: The referenced indices are shown for general market comparisons. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or transaction costs. Reference indices are provided for illustrative purposes only. There are no known published benchmarks or indices comparable to the investment strategies of the Fund.

The Variant Alternative Income Fund is a continuously-offered, non-diversified, registered closed-end fund with limited liquidity. There is no guarantee the Fund will achieve its objective. An investment in the Fund should only be made by investors who understand the risks involved, who are able to withstand the loss of the entire amount invested and who can bear the risks associated with the limited liquidity of Shares. A prospective investor must meet the definition of “accredited investor” under Regulation D under the Securities Act of 1933.

Important Risks: Shares are an illiquid investment. You should generally not expect to be able to sell your Shares (other than through the repurchase process), regardless of how the Fund performs. Although the Fund is required to implement a Share repurchase program only a limited number of Shares will be eligible for repurchase by the Fund.

An investment in the Fund is speculative, involves substantial risks, including the risk that the entire amount invested may be lost, and should not constitute a complete investment program. The Fund may leverage its investments by borrowing, use of swap agreements, options or other derivative instruments. The Fund is a non-diversified, closed-end management investment company, meaning it may be more susceptible to any single economic or regulatory occurrence than a diversified investment company. In addition, the fund is subject to investment related risks of the underlying funds, general economic and market condition risk.

Alternative investments provide limited liquidity and include, among other things, the risks inherent in investing in securities, futures, commodities and derivatives, using leverage and engaging in short sales. The Fund’s investment performance depends, at least in part, on how its assets are allocated and reallocated among asset classes and strategies. Such allocation could result in the Fund holding asset classes or investments that perform poorly or underperform. Investments and investment transactions are subject to various counterparty risks. The counterparties to transactions in over the-counter or “inter-dealer” markets are typically subject to lesser credit evaluation and regulatory oversight compared to members of “exchange-based” markets. This may increase the risk that a counterparty will not settle a transaction because of a credit or liquidity problem, thus causing the Fund to suffer losses. The Fund and its service providers may be prone to operational and information security risks resulting from breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Fund to lose proprietary information, suffer data corruption, or lose operational capacity.

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED FROM (877) 770-7717 OR WWW.VARIANTINVESTMENTS.COM. PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST. tnairavediserof

Foreside Fund Services, LLC, distributor.