04 Jan Q4 2018 Commentary

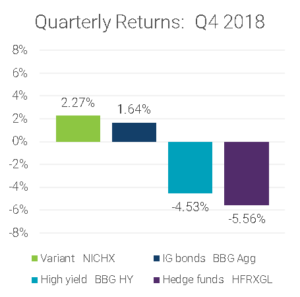

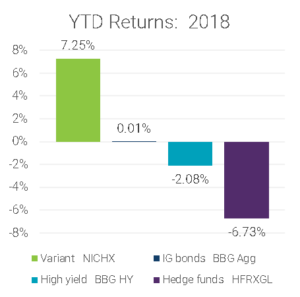

The Fund (NICHX) returned +2.27% in the fourth quarter of 2018, outperforming investment grade bond, high yield and hedge fund indices. For the full year 2018, the Fund was up +7.25%, an even larger outperformance relative to these same indices. The Fund’s emphasis on less correlated, private niches continues to provide for steady positive performance during this period of heightened market volatility. Over the quarter and since inception, the Fund has displayed limited correlation or beta to public market indices in fixed income and equity markets.

Past performance does not guarantee future results.

In terms of performance attribution, most positions performed at or near expectations. Exposure to specialized care in the UK, litigation finance (law firm lending) and portfolio finance were the leading contributors to results. Secondary market transactions in private market LPs also boosted returns, in particular, the acquisition of a litigation finance position towards the end of the year. The primary detractors from performance were exposure to life settlements, which has since been removed from the portfolio, and the write-down of a small business receivable.

Over the quarter, the Fund executed several new investments, including a direct deal in portfolio finance, a credit facility to a post-settlement litigation finance firm and the addition of a new specialty finance manager focused on small business lending. The Fund increased existing exposures in litigation finance, transportation finance and specialized care. As noted above, the Fund eliminated its current exposure to life settlements and, also elected not to rollover a lower yielding credit facility to a real estate firm. Lastly, the Fund established a line of credit toward the end of the quarter which will facilitate more efficient cash management going forward.

For current Fund performance and holdings please click here

Inception date is October 2, 2017. Returns are net total returns. Between October 2017 and September 2018, performance is quoted for the Variant Alternative Income Fund LP, the predecessor private fund that converted into the interval fund. The predecessor fund was, in all material respects, equivalent to the interval fund. The private fund track record was adjusted to reflect the interval fund’s estimated expenses and expense limitations. Specifically, it reflects a management fee of 0.95% and fund expenses capped at 0.50%. The track record uses geometric returns and reflects the reinvestment of earnings. Results are unaudited.

“Correlation” depicts the correlation, or the performance relationship, between the Fund and the reference indices on a monthly basis over the period. “Beta” measures the volatility of the Fund relative to the reference indices over the period.

“IG bonds” & “BBG Agg” refer to the Bloomberg Barclays U.S. Aggregate Index, which is a broad-based flagship benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market. “High yield” & “BBG HY” refer to the Bloomberg Barclays U.S. High Yield Index, which measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. “Hedge funds” & “HFRXGL” refer to the HFRX Global Hedge Fund Index, which is designed to be representative of the overall composition of the hedge fund universe. Please note: The referenced indices are shown for general market comparisons. Investors cannot directly invest in an index and unmanaged index returns do not reflect any fees, expenses or transaction costs. Reference indices are provided for illustrative purposes only. There are no known published benchmarks or indices comparable to the investment strategies of the Fund.